March 15, 2024

Technology

Tech Sector Investment Strategies for 2024

The technology sector continues to be a driving force in the U.S. economy, with innovation and digital transformation accelerating across industries. As we navigate 2024, investors need to adapt their strategies to capitalize on emerging trends while managing the risks associated with tech investments.

AI and Machine Learning: The New Frontier

Artificial Intelligence and Machine Learning technologies are no longer just buzzwords but have become integral to business operations across sectors. Companies leveraging these technologies effectively are seeing significant competitive advantages. Consider investing in both pure-play AI firms and traditional companies implementing AI solutions to enhance their operations.

Semiconductor Resilience

The global chip shortage highlighted the critical importance of semiconductors in our modern economy. As the U.S. invests heavily in domestic chip production through the CHIPS Act, semiconductor manufacturers and their supply chain partners present compelling investment opportunities with long-term growth potential.

Cybersecurity: Non-Negotiable Investment

With increasing digital threats and regulatory requirements, cybersecurity spending continues to grow regardless of economic conditions. Look for companies offering comprehensive security solutions, especially those focusing on cloud security, identity protection, and threat intelligence.

Balancing Growth and Value in Tech

While high-growth tech stocks can deliver impressive returns, they also come with significant volatility. A balanced approach might include established tech giants with strong cash flows alongside carefully selected growth opportunities. Consider metrics beyond growth rates, such as cash flow, profitability trajectory, and competitive positioning.

February 28, 2024

Real Estate

Real Estate Investment Trends in Growing US Cities

The U.S. real estate landscape is experiencing significant shifts as population migration patterns, remote work policies, and economic factors reshape demand across markets. Understanding these dynamics is crucial for investors seeking opportunities in residential, commercial, and mixed-use properties.

Sunbelt Surge Continues

Cities across the Sunbelt region continue to attract residents with their combination of affordable living costs, job opportunities, and favorable climates. Markets like Austin, Raleigh, Nashville, and Phoenix remain strong despite some moderation in growth rates. These areas offer potentially higher yields than traditional coastal markets, though investors should be selective as supply increases in some neighborhoods.

Secondary Cities on the Rise

As affordability challenges persist in major metropolitan areas, nearby secondary cities are benefiting from spillover effects. Consider markets within a reasonable distance from established hubs that offer quality of life advantages and developing business ecosystems. Examples include Chattanooga (near Atlanta), Sacramento (near San Francisco), and Colorado Springs (near Denver).

Multifamily Resilience

Despite interest rate challenges, multifamily properties continue to demonstrate resilience as housing affordability issues drive rental demand. Opportunities exist particularly in workforce housing – properties serving middle-income residents – where demand outpaces supply in many growing markets.

Adaptive Reuse Opportunities

The repurposing of commercial buildings, particularly office spaces, into residential or mixed-use developments represents an emerging opportunity in urban centers. These projects can offer value-add potential while addressing housing needs and revitalizing urban areas affected by changing work patterns.

February 12, 2024

Stock Market

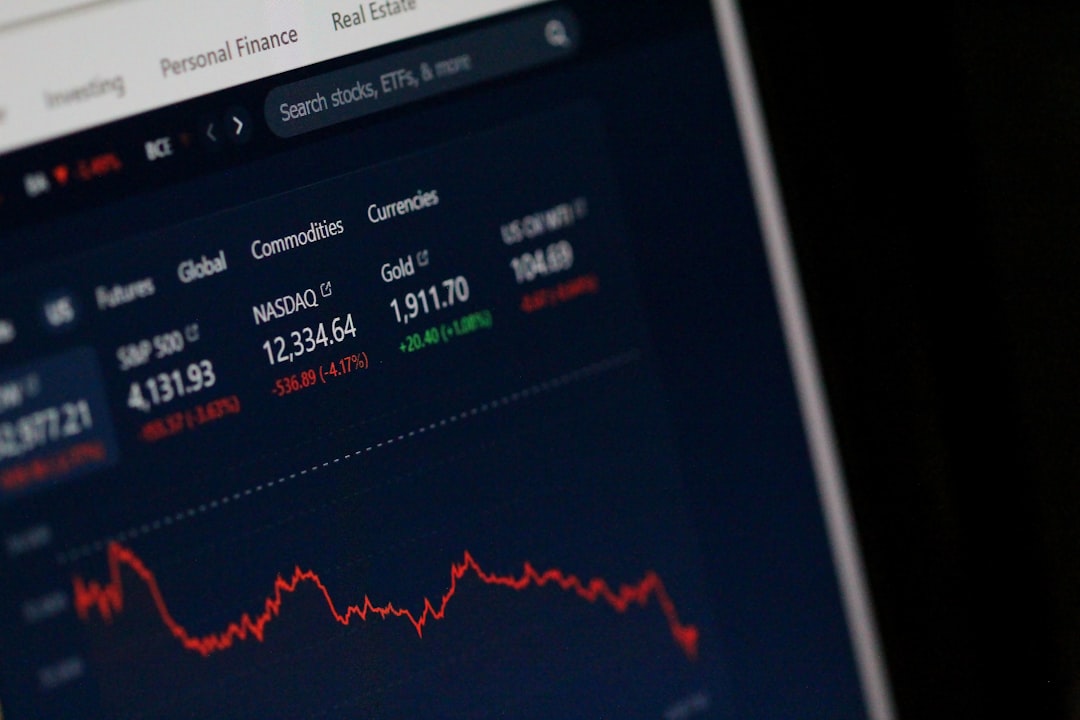

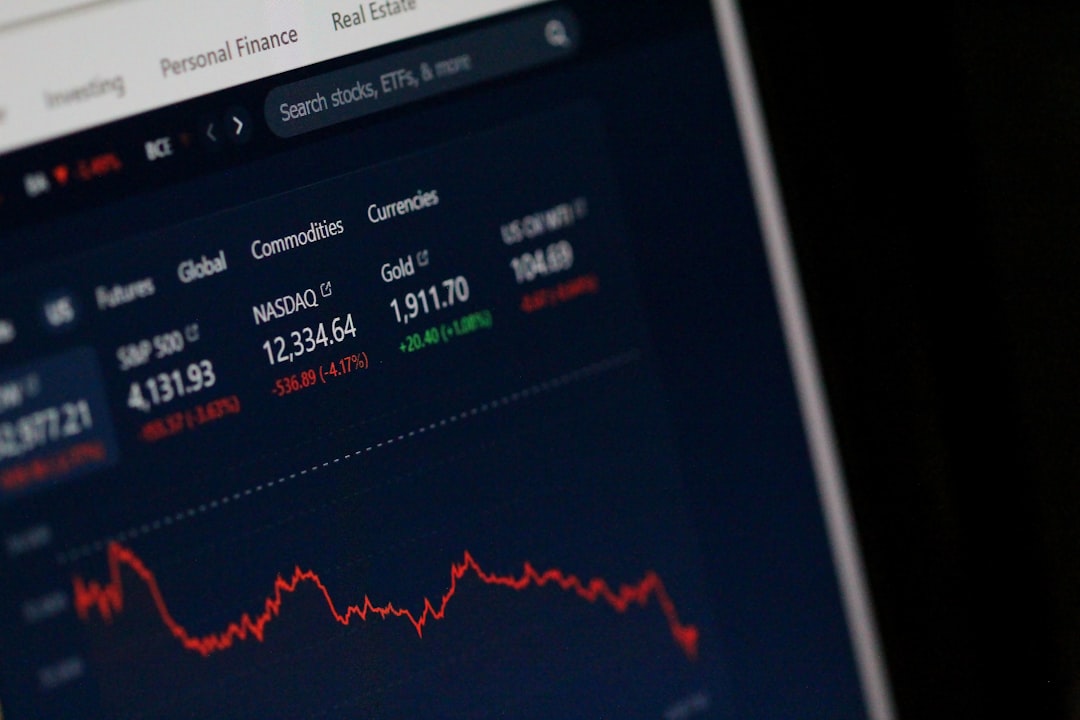

Stock Market Outlook: Navigating Volatility

Market volatility has become a persistent feature of today's investment landscape, driven by factors ranging from monetary policy shifts to geopolitical tensions. Developing strategies to not only survive but potentially benefit from these fluctuations is essential for long-term investment success.

Understanding Current Volatility Drivers

Today's market volatility stems from several sources: central bank policies adjusting to inflation concerns, ongoing global supply chain restructuring, geopolitical uncertainties, and the integration of AI across industries. Recognizing these factors helps investors distinguish between temporary disruptions and structural shifts that require strategy adjustments.

Defensive Positioning Strategies

During periods of heightened volatility, consider allocating portions of your portfolio to traditionally defensive sectors such as consumer staples, utilities, and healthcare. Companies with strong balance sheets, stable cash flows, and sustainable dividends often provide better downside protection while still offering upside potential.

Strategic Buying During Corrections

Market corrections, while unsettling, create opportunities to acquire high-quality assets at discounted prices. Develop a watchlist of companies with strong fundamentals and competitive advantages that you'd be willing to purchase at specific price points. Consider implementing a dollar-cost averaging approach during extended periods of volatility.

Options Strategies for Volatility Management

For experienced investors, options strategies such as covered calls can generate income during sideways markets, while protective puts can limit downside exposure during uncertain periods. These strategies require careful implementation and monitoring but can enhance portfolio performance when appropriately utilized.

January 25, 2024

Sustainable Investing

The Evolution of ESG Investing in American Markets

Environmental, Social, and Governance (ESG) investing continues to evolve in the American investment landscape, influenced by changing regulations, investor preferences, and corporate practices. Understanding the current state and future direction of ESG is important for investors seeking both financial returns and positive impact.

Regulatory Developments Shaping ESG

The regulatory environment for ESG investing is becoming more defined, with the SEC working on climate disclosure rules and other standards. These developments aim to address concerns about "greenwashing" while providing investors with more transparent, comparable ESG information. Stay informed about these evolving requirements as they will influence market practices and investment opportunities.

Beyond Environmental Factors

While climate considerations often dominate ESG discussions, social and governance factors are gaining increased attention. Companies with strong labor practices, diversity initiatives, community engagement, and robust governance structures are demonstrating resilience and long-term value creation. A comprehensive ESG approach considers all three dimensions when evaluating investment opportunities.

Sector-Specific ESG Considerations

ESG factors impact different sectors in unique ways. Energy companies face transition risks and opportunities as renewable sources expand, while technology firms contend with data privacy and labor issues. Understanding material ESG factors by sector helps investors identify leaders and laggards within industries rather than making broad sector exclusions.

Performance Metrics and Benchmarking

As ESG investing matures, more sophisticated performance metrics are emerging beyond simple exclusionary approaches. Consider utilizing specialized ESG indices, ratings from multiple providers, and forward-looking assessments of companies' transition plans when building and evaluating ESG-oriented portfolios.

January 10, 2024

Retirement Planning

Optimizing Retirement Investments in Changing Economic Conditions

Retirement planning faces unique challenges in today's economic environment, with inflation concerns, market volatility, and evolving tax considerations all impacting long-term investment strategies. Adapting your approach to these conditions is crucial for securing financial well-being in retirement.

Inflation-Conscious Asset Allocation

With inflation remaining a concern for retirees and pre-retirees, consider adjusting your asset allocation to include investments with inflation-hedging properties. Treasury Inflation-Protected Securities (TIPS), certain real estate investments, infrastructure assets, and select equities with pricing power can help preserve purchasing power over time.

Rethinking the 60/40 Portfolio

The traditional 60% stocks/40% bonds portfolio faces challenges in the current interest rate environment. Consider more nuanced approaches that might include alternative assets, various fixed-income instruments with different duration profiles, and global diversification. The goal remains balancing growth potential with downside protection, but the implementation may need updating.

Tax-Efficient Withdrawal Strategies

As retirement approaches or begins, tax-efficient withdrawal strategies become increasingly important. Carefully sequencing distributions from taxable accounts, tax-deferred accounts (traditional IRAs, 401(k)s), and tax-free accounts (Roth) can significantly impact your after-tax retirement income. Consider potential tax law changes when developing long-term plans.

Longevity Risk Management

With Americans living longer, managing longevity risk—the possibility of outliving your assets—is essential. Consider incorporating guaranteed income sources through appropriate annuity products, delayed Social Security claiming strategies, or other approaches that provide lifetime income streams to complement investment portfolios.